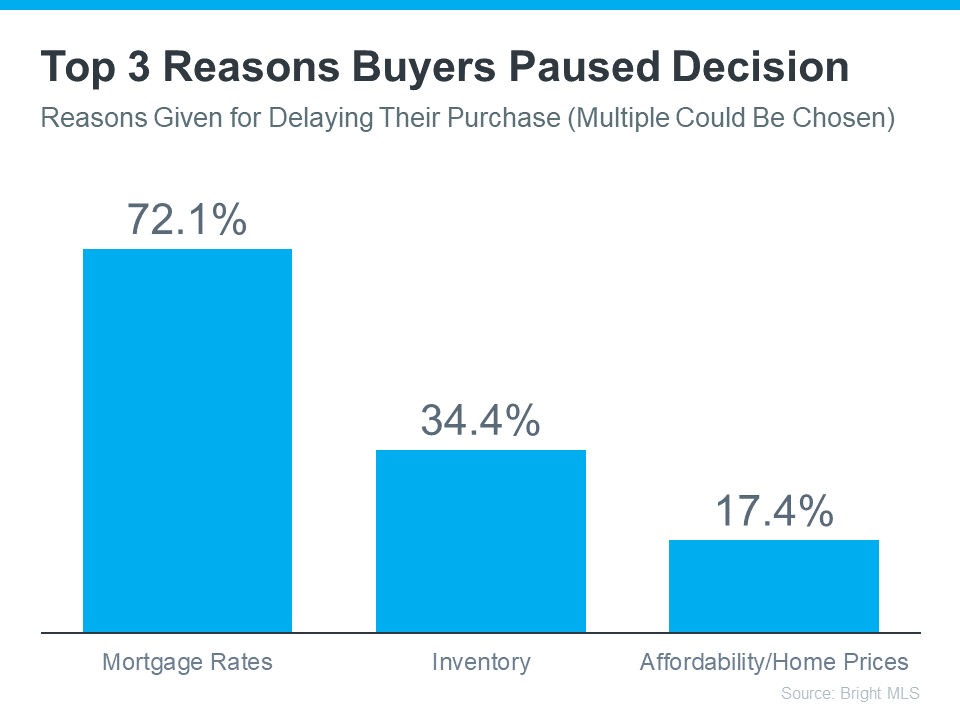

Hey there, future homeowner! 🏡 If you’ve been daydreaming about picking out your dream home, you’re probably also keeping a close eye on those pesky mortgage rates. They’ve been a bit of a rollercoaster, right? Last year, when they nudged close to 8%, it might have felt like your home-buying dreams took a hit. If that made you press pause on your plans, you’re not alone. (check the chart below) But don’t worry, we’re all in this together, and we’re here to help you navigate through it. So, let’s chat about what makes sense for you and keep that dream alive

Data from Bright MLS shows the top reason buyers delayed their plans to move is due to high mortgage rates (see graph below):

“Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

That’s because mortgage rates have come down off their peak last October. And while there’s still day-to-day volatility in rates, the longer-term projections show rates should continue to drop this year, as long as inflation gets under control. Experts even say we could see rates below 6% by the end of 2024. And that threshold would be a game-changer for a lot of buyers. As a recent article from Realtor.com says:

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

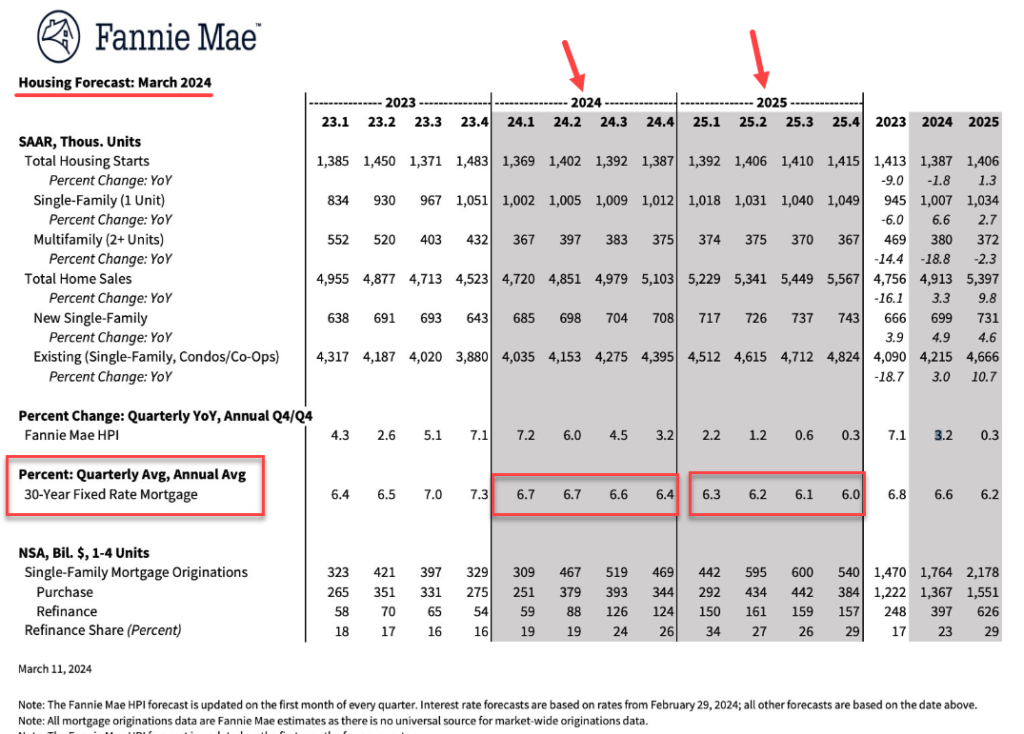

Fannie Mae Housing Forecast

March 2024 30-Year Mortgage Average

Note: Fannie Mae came out with their newest forecast in the middle of writing this post. Here’s what they are now expecting: Click Here for Entire Image

6.7% in Q2 2024 (previous forecast: 6.3%)

6.6% in Q3 2024 (p: 6.1%)

6.4% in Q4 2024 (p: 5.9%)

6.3% in Q1 2025 (p: 5.8%)

6.2% in Q2 2025 (p: 5.7%)

6.1% in Q3 2025 (p: 5.7%)

6.0% in Q4 2025 (p: 5.7%)

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead. If your plans were delayed, there’s light at the end of the tunnel again. That means it may be time to start thinking about your move. The best question you can ask yourself right now, is this:

What number do I want to see rates hit before I’m ready to move?

Deciding on a mortgage rate that makes sense is a personal decision.

Are you more comfortable at 6.5% or maybe 6.25 or even 6%?

Whatever it is, keep that number in mind and connect with a local real estate professional. They’ll help you stay informed on what’s happening. And when rates hit your target, they’ll be the first to let you know.

Bottom Line

Remember, while it’s difficult to predict exact mortgage rates, staying informed and prepared can improve your position when the right opportunity arises. If you have a specific rate in mind, keep monitoring the trends and work with a professional to ensure you’re ready to act when the time comes.

Call Finding Homes for You 636-532-4200 today!

How Even Small Interest Rate Changes Impact

What You Qualify For